Your Guide to Solar Federal Tax Credit

Disclaimer: This article is for information purposes only and is not intended to provide accounting, tax, or legal advice. Please consult your consultant or personal lawyer.

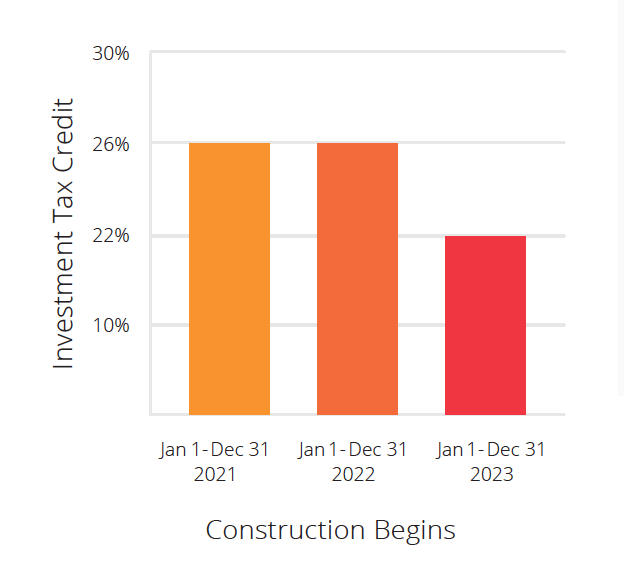

As the name suggests, the Solar Federal Tax Credit is a credit you can claim on your federal returns. It is the percentage of what you spend on installing a residential solar photovoltaic (PC) system in your home. At present, the tax credit is currently 26% of your total system cost. For example, if the total cost of your solar is $26,000, then you can claim a tax credit of $6,760. The total amount you owe on your income taxes will be $6,760 less.

Any U.S. homeowner can claim a tax credit for as long as the solar system is installed for a residential location based in the United States. Please note that it does not even have to be your primary residence. According to the Department of Energy, the federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

What does the Credit Cover?

The Federal Tax Credit covers the following:

- Cost of solar panels

- Additional solar equipment (e.g., inverters, wiring, and mounting hardware)

- Contractor labor costs for onsite preparations, assembly, or original installation, including permitting fees, inspection costs, and developer fees

- Energy storage devices that are powered exclusively through the solar (e.g., solar battery)

How much is the Federal Solar Tax Credit worth?

Are you Eligible to Get the Federal Solar Tax Credit?

To qualify for the full 26% federal solar tax credit this year, you must meet the following requirements:

- The solar PV system must be installed and operating by December 31, 2021

- The solar PV system must be installed in your primary and secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your home’s electricity consumption. The IRS has permitted a taxpayer to claim a section 25D tax credit for purchase of a portion of a community solar project

- The solar PV system must be owned (must be paid upfront or availed via loan). This means that homeowners who leased the system are not credible for the tax credit.

- The solar PV system must be brand new and used for the first time.

- The Federal Solar Tax Credit can only be claimed once for the original installation of the solar PV equipment.

How to Claim the Federal Solar Tax Credit?

In order to avail the tax credit for this year, the system must be installed, turned on, and generating power during this year too. It means that you can only get a credit in your 2021 tax filing if your solar system is up and running before the year ends. This means that if you only start a solar panel installation around November or December and do not have the system turned on this year, you can only claim the tax credit on your 2022 filing.

Note from SunPower:

A tax credit is not a tax rebate. While rebate pays you back, a credit offsets the balance of tax due. So if you owe little to no federal taxes, there is little to nothing to offset, and you may not be able to take full advantage of the credit.

On the other hand, if you pay at least as much in taxes as you get for your tax credit, you can pay off your tax debt with the credit and/or get the remainder after withholding as a refund. Even better, if you do not owe the full amount of your tax credit in the first year, you can roll the credit over to pay tax debt accrued in the following years (for as long as the ITC is in effect).

Are you still deciding whether to have solar installed this year or not? Feel free to chat with our professional solar consultants. You may also request for free quote below.

Sources:

[1] Office of Energy Efficiency & Renewable Energy

[2] SunPower

Attention 🙂

For our customers who want to personally file for their tax credit,

here is the link to the form: “‹”‹https://www.irs.gov/pub/irs-pdf/f5695.pdf

You can also find this link in the Solar Bill Review App 📲